Project viability for custom and self-build

Summary

Custom and self-build (CSB) housing opportunities, as with any residential development, will need to be appraised in terms of financial viability to support planning decisions by the Local planning Authority. (LPA), or to support business decisions by a proposed developer. The principles of how these appraisals are carried out for residential development are, in the main, the same for CSB developments, apart from several key differences.

This advice note covers the general principles of development viability and highlights issues specific to self and custom build in appraisals for plan making and decision taking. This advice note should be read alongside Right to Build Task Force Advice Note on Development Models.

This advice seeks to provide custom and self-build context for viability assessments. Suitably-qualified viability consultants should be commissioned to undertake robust appraisals prior to committing to specific schemes or policies.

Contents

Introduction

Background

Custom and self-build viability for plan making

- General principles

- Factors in appraisals

- Development costs

- Land value for residual appraisal

- Other factors

Percent of plots on large sites as custom and self-build

Custom and self-build typologies

- Enabler-led development

- Community Land Trust developments

- Individual self-builder

CSB additional considerations

Key points to remember

Introduction

Viability appraisals look to consider the end value of a development, and/or the value of the long-term revenue income, against the total costs incurred in bringing the development forward, including an element of profit. Planning Practice Guidance sets out the requirements for viability testing of local plans.

A Residual Valuation approach is generally used for planning purposes. In this model the appraisal is based on a deduction of development costs from the anticipated proceeds. The residual is normally either development profit or land value. The viability test is to determine if the residual value will be sufficient to acquire the land delivering sufficient uplift for the owner and profit for the builder. It should be noted that a viability appraisal is not the same as a valuation, although some methodologies may be employed in both.

Viability assessments can be taken at different development stages. Initial appraisals will be based on assumptions, becoming more detailed and accurate as aspects of the scheme are firmed up. For assessing the viability of local plans, viability is based on notional “typologies” of development rather than specific details. Large or strategic sites will require a level of detail in relation to requirements and land take etc, and these will usually be set out through indicative masterplans.

For a project to be ‘viable’ all parties must be satisfied that development can achieve its goals with acceptable levels of profit/income:

- Landowners will need to achieve sufficient return to encourage the release of land

- Developers/custom builders will need to generate sufficient profit or individual benefit to bring the project forward; open market homes and plots will need to be priced at a level affordable to the target end purchasers.

- Councils must be satisfied that the development will meet policy requirements including provision of infrastructure and public benefits.

Custom and self-build viability for plan making

The National Planning Policy Framework 2021 (NPPF) is clear that viability is an important planning consideration when councils prepare their Local Plans and make planning decisions. Planning Practice Guidance that supports the Framework provides further details on how these considerations should be considered. Key to viability is ensuring that local plan policies, and specifically those requiring setting requirements on development, such as infrastructure or affordable housing contributions, have been tested to ensure the plan, as a whole, is deliverable.

CSB homebuilding developments form part of the housing market and, under the NPPF, any Local Plan policies and proposals that affect private homebuilding should be included in the overall soundness assessment of the Plan. Consequently, a Local Plan Viability Appraisal should consider policy impacts on CSB development, in particular enabler-led development.

General principles

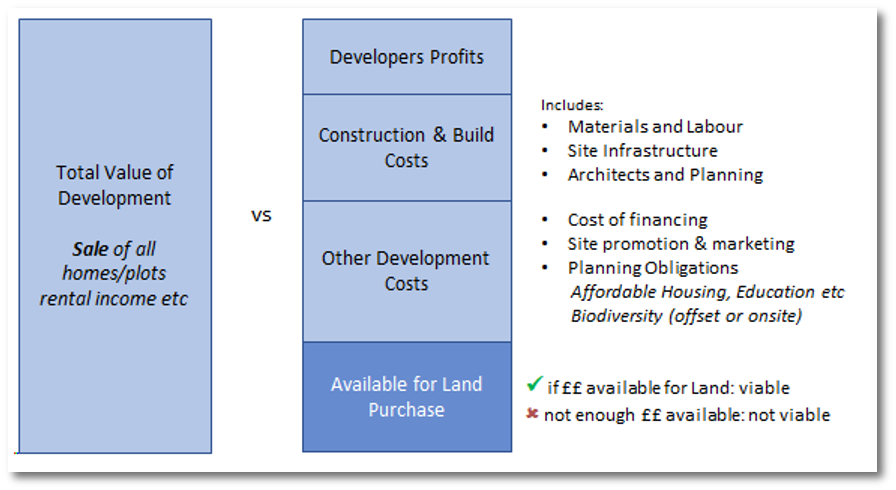

The most common approach to viability for plan making or initial development consideration follows the Residual Method. This simply looks at the finished value of the development, minus development costs (including profits) to determine if the residual is sufficient for purchasing the development land as follows:

value of completed development - development costs - developer profits = amount available for land purchase

The residual model

It is important to note that self and custom build is liable for any Planning Obligations set out in policy, despite being exempt from CIL charges. For a single dwellings, obligations are generally limited to small sums per dwelling for required contributions e.g. for strategic habitat mitigation.

For larger commercial and CLT/group CSB schemes, councils’ requirements for a percentage of dwellings to be delivered as affordable homes will apply. For modest scale schemes delivering only one or two affordable homes, councils often accept commuted sums for offsite delivery of social/affordable housing. Where homes are to be constructed and transferred to a registered provider of affordable housing it can be assumed the transfer value will cover construction costs plus a small “contractor’s profit” for construction of the dwelling.

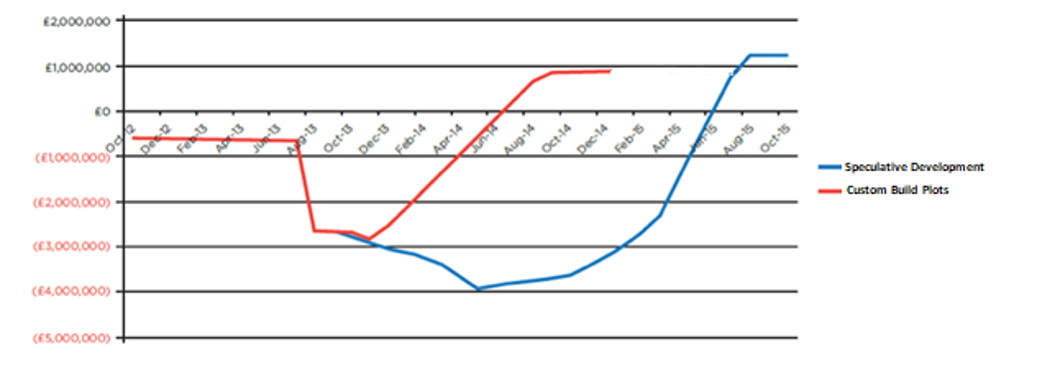

The residual method is a broad estimation and changing minor assumptions can lead to large variation in output. The detail of financing costs and cash flow are critical factors and can be significantly different when dealing with self and custom build. In speculative development the builder pays for construction of the complete building prior to realising any income from sale. In self/custom build the builder pays for servicing and fees but realises sales from plots earlier on and does not finance the dwelling construction costs.

The following illustration shows indicative cash-flow implications for two housing projects on the same multi-unit site over time. A promoter of a CSB homebuilding development (the red line) is likely to require less cash for a shorter period of time. Operating profit on completion is slightly higher for a builder bringing forward a speculative housing development (the blue line) but requires considerable upfront capital for a longer period.

Indicative cash-flow implications of CSB vs speculative housing

Finally, the Government’s Help to Build equity loan scheme is operation and, as this becomes mainstream, it may broaden access to self and custom build for individuals, but it is not yet clear that this will have a fundamental impact on the viability of specific schemes.

Factors in appraisals

The following provides high-level description of those factors commonly referred to in viability assessments. The specific detail is very sensitive to local land and housing markets, and viability consultants can advise on specific factors to use. The practice of plan viability for strategic sites and speculative housebuilding is well established. The following highlights where CSB schemes may differ from standard speculative residential build.

Gross development value: This is the total sales receipts and/or capitalised net rental income from the development. This includes market value sales of land and properties and transfer/sale receipts for affordable homes. Where a large/strategic site includes a proportion of self-build plots the sale of the custom build parcel or individual self-build plots will form part of the development value. Market values should be based on locally-comparable properties and sensitivity testing of a rise or fall in property prices can be included. The scarcity of self-build plots means these can bring a premium.

Contractor profits: Where housebuilders construct affordable homes for transfer to a registered provider it is reasonable to assume the housebuilder will receive a modest percentage profit on the cost of construction for those dwellings. This will generally be apportioned with the agreed transfer (sale) value.

Development costs

Build costs: The cost of materials and labour for the construction of the development. Generally based on Building Cost Information Service (BCIS) data which is kept up to date based on empirical contract values. This cost is based on per m2 of residential property. Cost of materials, fixtures and fittings will generally be lower for volume builders due to economies of scale. With CSB development the build cost will be factored differently.

Where a project provides only serviced plots for sale to private homebuilders there will be no build costs incurred, other than a proportional cost of the site infrastructure and the cost of the foundations if a ‘Golden Brick’ solution is offered (see Briefing Note on Taxation). Where shells or custom homes are sold the build costs will be paid by private homebuilders as the homes are constructed and not included in project build costs.

The build cost of CSB homes will match individual’s budgets and preferences; a self-builder on a tight budget can introduce savings through undertaking work themselves or by phasing internal fit out to match their budgets. Self-builders with large budgets may optionally wish to have higher specification materials, but this viability is self-levelling. It should not be assumed that all CSB dwellings will be overly large (m2) and should be modelled with a standard dwelling type and size profile.

Site infrastructure and opening costs: The site-specific infrastructure costs include access roads, sustainable drainage systems, green infrastructure, connection to utilities, decentralised energy and more. This is often estimated as a percent of build costs and/or a per-plot figure. For larger schemes this may be costed based on an indicative masterplan. For self-build plots the assumption is that utilities are taken to the plot edge ready for connection, and the per-plot cost will be the same as for the rest of the development.

Professional fees: This is including planning and legal fees etc. This is generally modelled as a percent of build costs or per dwelling/plot. Custom build enabler schemes may involve direct support for the customisation and specification, which may involve more professional advice (architects, cost managers) and the planning costs may be slightly higher due to bespoke design codes etc. Consequently, these fees may be higher than in speculative builds.

This cost will also include marketing fees. For volume builds marketing costs will include the cost of show homes etc and marketing budgets may be based on a percent of the market sale value of the development. With self and custom build the marketing fees will likely be different, but as a minimum something comparable to estate agent fees for plot sale plus a small addition may be assumed.

Abnormal costs: Site-specific costs for a development. These may include a range of elements, such as extra-ordinary earth moving or land stabilisation, brownfield contamination treatment, works to listed buildings etc.

Planning obligations: These will depend on specific local planning policies but generally include contributions for green infrastructure, community infrastructure (education, sport etc), affordable housing and other reasonable planning requirements secured by s106 agreement. Self and custom build dwellings are not liable for CIL as long as the planning application is clear on the phasing of delivery and correct process. Plot purchasers assume CIL liability prior to commencement and can provide the required evidence of self-build and principal residency for the initial period of occupation.

Finance costs: cost of loans required for delivery.

Grant & other subsidies. Where an element of rented, or part rented, housing is proposed and some ownership is to be retained in the long term, revenue elements will also need to be considered. In practice this is not a significant issue in self/custom build though a mixed tenure scheme will likely involve either transfer value of homes or plots to an affordable housing provider or some form of rental.

Developer return/profit: The PPG states that ‘For the purpose of plan making an assumption of 15-20% of gross development value (GDV) may be considered a suitable return to developers in order to establish the viability of plan policies’. This figure relates to speculative market development. Dependent on the type of CSB housing delivered, the level of profit expected may vary and a level of profit similar to that of a contractor may be more appropriate.

External build costs: where costs for items such as sheds, garages or landscaping are not included in the build costs this can be factored in based on per-dwelling estimates.

Land value for residual appraisal

Land value: The basic land value is the Existing Use Land Value (EUV). For viability testing the benchmark land value is Existing Use Value plus a landowner premium (referred to as EUV+). The premium for the landowner should reflect the minimum return at which it is considered a reasonable landowner would be willing to sell their land. The premium should provide a reasonable incentive, in comparison with other options available, for the landowner to sell land for development while allowing a sufficient contribution to fully comply with policy requirements. There is often a big difference between what a private homebuilder is willing to pay for a plot, compared to a volume builder. CLT/Collective Self-build schemes often rely on altruistic landowners and these may not meet the assumed benchmark land values. Local Plan inspectors will generally accept this as an exceptional case unless there are overriding objections.

Other factors

Stamp Duty Land Tax (SDLT) and VAT: Where serviced plots are sold enablers will not incur these taxes, because the individual private homebuilders will pay the SDLT on the purchase of the land. Any VAT costs incurred will however need to be taken into account (the Essentials: Note on Taxation provides further details).

Risk: Risk is generally factored in in relation to the cost of borrowing. Once a site is serviced, plot sales rates may be higher or lower than speculative housebuilding, but no individual dwelling construction costs are borne by the developer (other than perhaps show homes in the large site model). Contractual controls on delivery as part of plot sale can ensure homes are built to the timetables and standards required.

Finance: CSB development models allow the custom build homeowner to secure payment from the purchaser as the project progresses, rather than at completion, so reducing the need for finance. Payments may be sought at exchange and completion of the land purchase and then as stage payments as the build progresses. Community-led housing projects may be boosted by grant funding, enabling partners or altruistic landlords to secure a funding package for delivery.

Phasing: Strategic sites may be delivered in phases which may impact cash flow and longer builds have greater uncertainty in terms of viability. Self and custom build plots and developments (parcel of plots) are generally smaller in scale and treating these as separate developments or a stand-along phase simplifies viability testing.

Inflation (build costs, cost of borrowing etc) and fluctuations in the housing market can be modelled to test sensitivity. As custom/self-builders have motivation beyond investment/profit po

Percent of plots on large sites as custom and self-build

At the time of writing, around 1/3 of LPAs have an adopted or emerging planning policy seeking a percentage of self-build plots on large, major or strategic residential sites. The CSB element can be excluded from the development and modelled separately as stand-alone custom build development. Alternatively land, servicing, opening up costs, etc are apportioned to the number of plots and local market prices for serviced plots can be added to the gross development value. Those parcels of plots will generally be purchased by a custom build enabler or plots may be serviced and offered for market sale.

In either approach the impact of including self and custom build plots is cash positive. The difference in opportunity cost (i.e. an increased number of mass market homes with increased profit) is not relevant to assessing plan policy viability. In plan making the test is if schemes are viable, not to determine the highest profit or GDV potential for a site.

Custom and self-build typologies

Assessing scheme and plan viability will vary depending on the type of scheme. The Right To Build Task Force identifies several types of CSB development including:

- Enabler-led multi-plot development

- Serviced plots

- Custom homes

- Community Land Trust/collective self-build

- Individual self-builder (single dwelling developments)

When undertaking viability assessments councils should also have regard to the different scales of private homebuilding that might come forward. These can be large developments, but multi-plot sites are more typically between ten and 50 homes.

While volume/regional house builders may offer some choice in materials and layout, none at present offer sufficient self-commissioning or customisation to meet the definition of CSB homes.

Enabler-led development

Custom build enablers build on two basic models: serviced plots and custom homes offering. With serviced plots, the site promotion, planning (design code, plot passporting etc), acquisition and servicing costs are borne by the developer (enabler) with sale price of plots covering these costs and enabler profit. In the custom homes offering, the enabler works with housebuilders (often off-site manufacturers/ kit home providers) to help the plot purchaser configure and order their dwellings from a specific range of suppliers. In these cases, the enabler may also receive a level of profit or fee based on the cost of the home for services or on-site development works often including site management.

In both models all dwelling construction costs are financed directly by the home purchaser. Plot prices will reflect the open market value for self-build plots and will reflect the size of plot and potential size of dwelling as set out in plot passports.

As these will more often be Major development (> 10 dwellings) the planning obligations will need to be considered. These will be in keeping with any market housing schemes modelled and will be based on tenure and dwelling size mix requirements set out in policy. The assumptions about build out rates can follow standard delivery models or can be adjusted where evidence shows self-build capacity and demand.

Community Land Trust developments

The financial delivery model of these schemes will generally be bespoke and may involve an element of subsidy. Most often these schemes are based on discounted land which may be gifted or acquired by the community group from an altruistic landowner. Construction can be done jointly or individually depending on how the CLT is constituted and homeowners will likely have “sweat equity” in the build.

Home sales may be by direct purchase of freehold/leasehold as a market dwelling or a purchase with a form of shareholding and resale restrictions. This may impact the market value of homes which means that finance and viability assumptions may need to be adjusted. Some LPAs will agree that subject to local connection clauses or discount market sale conditions CLT homes can be considered affordable dwellings. There will usually be no “developer profit” for the CLT, though these schemes are more likely to include communal space and facilities which will be delivered through the value of the development.

Viability testing of this type of development should include assumptions about low/no cost land and potentially grant funding support where the LPA or other body has expressed in principle plans to provide some support.

Individual self-builder

For many self-builders the personal benefit of having a home designed to meet their needs is the primary motivation – not profit or equity. The creation of a self-build dwelling, particularly though active participation in management, construction or finishing, reduces build costs and creates “sweat equity” in the finished dwelling’s valuation. There are savings on stamp duty and self-builders also can also set their build cost (through choice of materials etc) to match their personal budget thus creating their own viability benchmark.

Analysis of several LPAs’ self-build land supplies shows that up to 1/3 or more of individual self-builds are carried out on sites that are demolition/rebuild. For many this is the only way to access a building plot due to planning restrictions. As such the plot purchase is in fact the purchase of an existing home. Such builds are market-seeking and the self-builders budget sets the parameters and there is no need to model the viability of such sites. Furthermore, viability of such schemes is not fundamental to local plan delivery (see advice on assessment of demand/need).

CSB additional considerations

In essence the traditional speculative volume housebuilder model secures its competitive advantage from economies of scale and easier access to land and finance. Whereas the competitive edge for CSB comes from offering improved consumer choice and, with certain models, reduced levels of development risk and capital employed.

Alternative project types, models, and approaches may be adopted: several CSB development models exist including serviced parcels, serviced plots, ‘Golden Brick’ plots, weathertight shells for self-finish and completed turnkey properties, as well as community-led and affordable housing. Each of these has different levels of investment required, timescales, cashflow and anticipated profit. Single unit projects brought forward by individuals to build their own homes will have their own considerations, possibly including self-financing, limited infrastructure, no marketing costs, a desire for a high level of equity.

Where a CSB enabler is looking to bring forward serviced plots, the level of profit anticipated will be based on the value of the serviced plots. Unlike standard speculative development, profit is not realised by a single developer and final “value” of the development is held by the individual households. Some planning obligations, based on per-plot requirements, fall to the plot purchaser to pay. Where planning obligations are on the development as a whole, viability appraisals need to assess whether this makes the development viable within the enabler’s area of responsibility.

It also appears that some CSB purchasers often view this purchase as a ‘once in a lifetime’ or opportunity and may seek to achieve the largest house possible within their budget and to the highest specification achievable. So CSB property values may not be directly comparable to those in the local housing market as property sizes and quality may be vastly superior. However, the resale of such properties is likely to be caught by local market ceiling values and the bespoke nature of the design may limit the resale market, although the quality and specification of the property may counter this.

Key points to remember

- Local Plan viability assessments should test impacts on different forms and scales of multi-unit CSB developments as part of wider housing assessments.

- Self-build schemes are liable for the same planning obligations as any development. Planning obligations should be reasonable and proportionate, and viability assessments should be clear where financial contributions are to be borne by the plot purchaser vs the enabler (developer).

- Group self-build and Community Land Trust schemes may not appear viable as they may rely on altruistic landowners or grants and motivation is not profit or end-value of the development.

- If a large/strategic development requires a percentage of plots delivered as custom or self-build, this can be modelled in two ways. The CSB element can be excluded from the development and modelled separately as stand-alone custom build development. Alternatively, land, servicing, opening-up costs, etc are apportioned to the number of plots and local market prices for serviced plots can be added to the gross development value. In practice these are cash-positive for a development.

- Construction costs of the self-build dwellings can be excluded from developers’ costs and plot sales modelled as income with site servicing and opening-up costs apportioned to plot sales value.

- This advice seeks to provide custom and self-build context for viability assessments. Suitably qualified viability consultants should be commissioned to undertake robust appraisals prior to undertaking investment or policy decisions.